The following article is an abridged and edited version of Master Susman’s Reading as Lent Master Reader 2023, delivered at his Reader’s Feast on Tuesday 21 February 2023.

My aim is to provide a non-technical introduction to cryptocurrency for those to whom it remains a complete mystery.

Money is what takes us beyond a barter economy by which goods or services are exchanged for other goods or services. Use of gold or silver as a medium of exchange probably started in China (but certainly elsewhere as well, including on Easter Island, where large, carved stone heads are believed to have had this purpose). The gold and silver used as currency in ancient times was authenticated by rulers stamping gold or silver ingots to verify their purity. Then some ruler, somewhere, perhaps about 3,000 years ago, started to produce smaller pieces of gold or silver, each with a separate stamp of authenticity, thus inventing coinage. Perhaps about 2,000 years ago (and again, probably in China) paper was substituted as more convenient to carry around, in due course regarded as a legally enforceable promissory note (so that in the UK we talk of a ‘note’ of whatever denomination), or bill of exchange (so that in the USA they talk of an equivalent ‘bill’).

If you put your money in a bank, the bank will wish to lend it to someone else, repayable to the bank with interest. In which case, where is your money while it is out on loan by the bank? It is on a ledger: think of A Christmas Carol by Charles Dickens (at one time himself a Middle Temple student), and his description of Bob Cratchit keeping a ledger for Ebenezer Scrooge; and be sure also to look at the facsimile just before the entry of Middle Temple Library of the petition from Dickens saying that his novels were doing quite well, so that he was abandoning his plan to go to the Bar, and asking for the return of his deposit, which our Librarian says we repaid him. Of course, nobody would now keep a ledger with a quill pen, sitting on a high stool. The ledger would be kept on a computer, so as to record (from the bank’s point of view) how much money its customer owes the bank (the debits), and how much the customer is entitled to claim from the bank (the credits).

Documents can be shared by anyone using the public post, and by lawyers using the private DX (Document Exchange). Each system has a central sorting office. By contrast, emails do not use a central sorting office, but exist under a so-called ‘peer-to-peer’ system which requires first the use of a computer (including the miniaturised computer we call a mobile phone); second an internet service provider (which might be characterised as a ‘public key’, because any member of the public can have access to one as the key to sending emails); and third a private email address (which might therefore be characterised as a ‘private key’).

Combining the idea of a computerised ledger with the idea of exchange of peer-to-peer emails by computer will explain the idea of a system using computers to exchange money. In effect such a system was devised in 2008. One person or a group came up with the idea of a computerised ledger, the data stored on which was common to every participant. That idea was attributed to an individual identified as ‘Satoshi Nakamoto’, apparently a Japanese name, but whether the idea came from Japan has been doubted. Some have claimed that it came from an Australian pretending to be Japanese. In Tulip Trading Ltd v. Van der Laan [2023] EWCA Civ 83, it was recorded at paragraph [17] of the judgment of the Court of Appeal that the claim by a Dr Craig Wright (who was connected to the Claimant in that case) to be Satoshi Nakamoto was ’hotly disputed’. The idea of a computerised ledger being shared by anyone who subscribes can be called a ‘distributed ledger’, because the same data held in the same form is distributed and reproduced among each and every participating computer, and any change in that data is changed on every participating computer. To gain access to the data contained in this distributed ledger, a participant user needs a ‘public key’ (identifying the provider of the system), and a ‘private key’ (for individual access). Typically, in these days the ‘private key’ is a string of about 70 unrelated characters, virtually impossible to memorise, and with no central register record. Therefore, the ‘private key’ needs to be carefully and safely stored, lest it and access to the data to which it relates is lost for ever. One man has been reported in the press to have mistakenly disposed of the computer drive on which he had stored his private key for cryptocurrency worth millions, and now to be spending his life searching a rubbish dump in the hope of finding it. One must also beware of dying without having given a copy of one’s private key to one’s heirs.

In order to keep a block of data that is stored on the distributed ledger sufficiently limited in size for ease of access, each block is soon sealed so as to preclude further entries or changes, and a new block is started. With Bitcoin this is said to happen about 4 times an hour (but this may be less frequent with some of the over 1,000 other cryptocurrencies). The system for making a new block is called ’mining’, by analogy with digging up gold or silver, although there the analogy ends, because ‘mining’ in this sense involves a competition to be first to succeed by trial and error to discover a code (known as a ’hash’). Whoever has the best and fastest computer should win the competition and be rewarded (in the case of Bitcoin, the reward will be a quantity of Bitcoin). It is not generally known who is setting the competition, although some have suggested that it is set by individuals operating in China, or randomly by a computer program. It is certainly a very, very wasteful process, because the amount of electricity that is consumed by the winning computer (not to mention the losing computers) is said to be enough to heat and light a small town in the UK. Once the ‘hash’ has been found and a new block set up, no changes may be made to the data on the previous block, and the new block is chained to the previous blocks, which is why the chain of blocks is called a ‘blockchain’.

Creating a cryptocurrency is no different in principle from creating any other computer program (for example, a Chambers website). The computer was developed from numerous contributions by such people as Charles Babbage, who made a working mechanical computer in the middle of the nineteenth century; Alan Turing, who helped develop the first advanced electronic computer at Bletchley Park during the Second World War; and Tim Berners-Lee, the developer of the World Wide Web (each of whom happened to be British). A computer processes and stores information (data). As a metaphor, the storage may helpfully be imagined as a large warehouse containing nothing but an immense floor filled with buckets, each bucket being either full of water or empty. The processing may accordingly be imagined as the computer emptying or filling a bucket. A bucket is either full or empty, so the system is binary. The processing may also be imagined as a current going through a series of gates, where the only possible routes forward are to the left or to the right, and where each gate is a transistor. The instructions to the computer (whether imagined as filling or emptying buckets or going left or right at a gate) may be expressed as a machine-readable code of noughts and crosses, or in an invented coding language which can be written and read by human beings. That is the present system, but the next development of computers is expected to take advantage of quantum mechanics, the science of very small things (such as electrons) that do not act in accord with Einstein’s explanations of how big things work. For the time being, a program may be written in code by human beings, installed on a computer, and operated on that computer with the results stored on that computer, including in the form of a distributed ledger, and used not only for cryptocurrency but for a variety of other applications, such as recording vehicle registrations; or controlling a chain of supply of commodities (for example, rice planted in the Far East and ending up on a supermarket shelf in the UK); or for draft ‘smart contracts‘ or ‘smart wills’ (although it may be better to use a smart living lawyer who can advise on possible pitfalls in the use of standard forms of either).

Cryptocurrency may be stored in a ‘virtual wallet’, which may also be used to store a crypto token which could be held there or exchanged for cryptocurrency by a process called ‘minting’ (not to be confused with ‘mining’, the creation of a new block in a blockchain, as it has been in at least one recent judgment). Similarly, a ‘non-fungible token’ (NFT) may be created, such as an artwork that a person may own but may only admire on a computer. In Osbourne v. Persons Unknown Category A [2023] EWHC 39 (KB), where it was alleged that artworks which existed as NFTs had been unlawfully abstracted from a virtual wallet into successive further virtual wallets, Lavender J agreed that the documents of claim could be served by the claimant by way of placing an NFT in one of those wallets, in the hope that it would then be passed on successively, and could be shown to constitute good service on any person who opened one of the virtual wallets. It has not yet been disclosed whether this attempt at service on persons unknown was effective.

The essence of the crypto world is that it is intended to be secret, and not to be controlled by any government. China has tried to control it but appears not to have succeeded so far. Those who invent forms of cryptocurrency or crypto tokens on a distributed ledger, usually then try to sell them by way of a so-called ’white paper’ which specifies ’this is not a prospectus’, with the intention of avoiding the liability for misinformation which would exist in the case of a prospectus. One might compare the painting of a pipe by the surrealist Magritte, captioned Ceci n’est pas une pipe (This is not a pipe, presumably intended to mean more than ‘it is only a painting of a pipe’). Similarly, a white paper could be viewed as being a prospectus captioned ‘this is not a prospectus’, and the Financial Conduct Authority has somewhat surprisingly accepted that it has no power to regulate white papers. The crypto world attracts fraudsters, to the additional ultimate benefit of the many lawyers trying to solve some of the problems which have arisen from the fraudulent use, or fraudulent extraction of cryptocurrency: to pursue that subject further, I recommend Master Pelling’s speech entitled ‘Issues in cryptocurrency fraud claims’, which starts where this present account leaves off, and which is easily found on the internet by searching for ‘Pelling’ or for ‘crypto’.

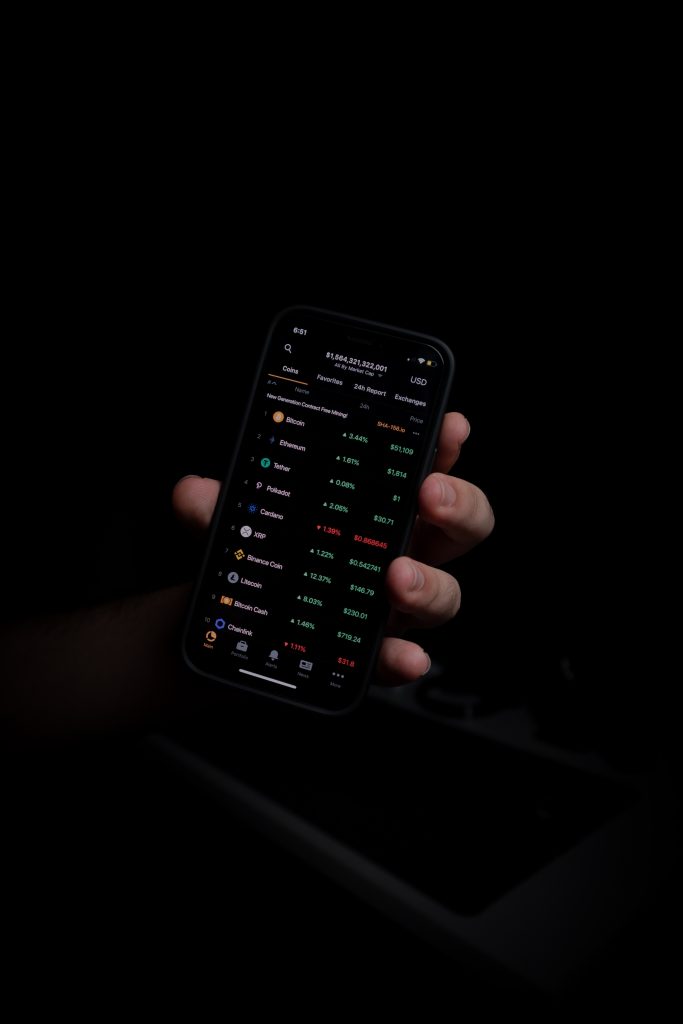

Cryptocurrency is not backed by gold stored in the Bank of England, or in the USA at Fort Knox, or anywhere else, and it has no such intrinsic value. The price at which cryptocurrencies are sold and bought is highly volatile, inviting the question, ‘is it a bubble?’, to which the answer must surely be ‘yes’. As to whether it is a wise investment, my answer is ‘yes, provided that you are happy to gamble, and that you do not care whether or not you win or lose’. Would I myself invest in cryptocurrency? Absolutely not.

Master Peter Susman practices from Henderson Chambers, specialising in contract litigation, particularly concerning complex commercial or high technology areas, including construction and engineering, information technology, the regulation of business and of professionals. He has law degrees from the Universities of Oxford and Chicago, and at one time worked as a corporate lawyer in New York City.